Trade Finance for Oil and Gas: Challenges and Opportunities

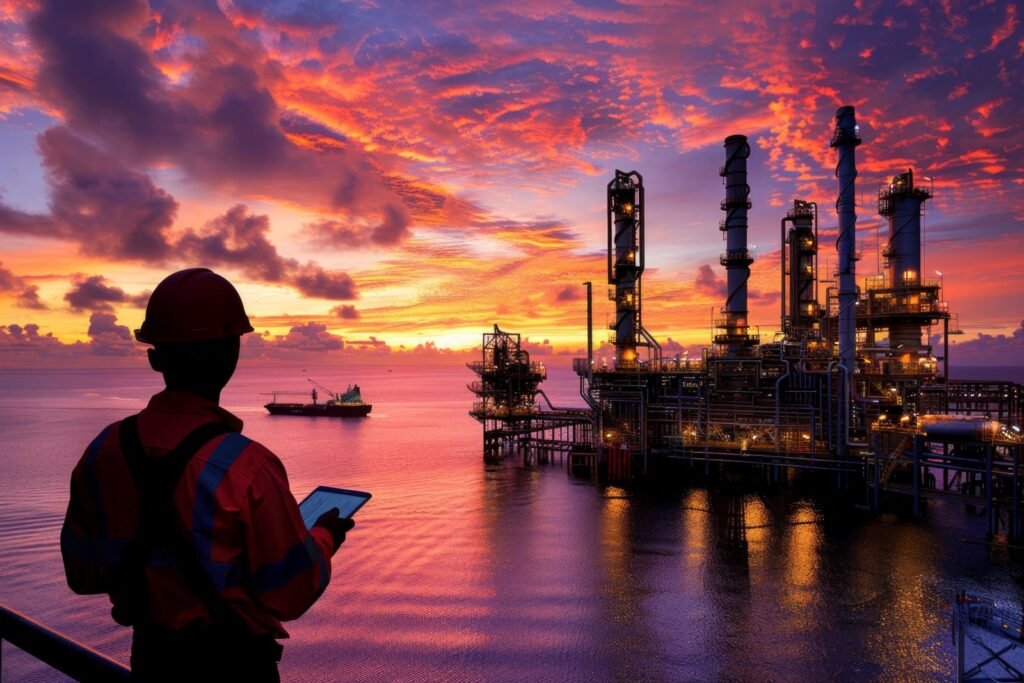

Trade Finance for Oil and Gas: Challenges and Opportunities The oil and gas industry is capital-intensive, politically sensitive, and globally interconnected—making trade finance not just important but essential. With complex transactions that span continents, high-value contracts, and fluctuating commodity prices, companies in this sector face unique financial and operational risks. Trade finance acts as a strategic enabler, helping firms manage liquidity, mitigate risk, and seize time-sensitive opportunities. Image by freepik This blog will help you uncover how trade finance can solve some of the most pressing issues faced by oil and gas traders, suppliers, and contractors. Whether you’re dealing with delayed payments, geopolitical disruptions, or large upfront capital requirements, you’ll discover actionable ways trade finance can reduce risk and support your global operations—so you can focus on growth and profitability. Imagine securing a multimillion-dollar crude oil contract, only to hit a roadblock because your supplier demands upfront payment and your cash is tied up in another project. Or being forced to walk away from a lucrative LNG deal because your buyer requests financial assurances you can’t provide fast enough. These aren’t just what-ifs—they’re daily realities for businesses in oil and gas. In an industry where timing is everything, trade finance solutions can mean the difference between winning and losing a deal. “In the volatile world of oil and gas, trade finance isn’t just a financial tool—it’s your ticket to compete in global energy markets.” — Rajiv Thakkar, Senior Energy Finance Advisor By continuing through this article, you’ll gain a solid understanding of the specific challenges trade finance addresses in the oil and gas sector. You’ll learn how to leverage instruments like letters of credit, performance guarantees, and supply chain finance to protect your operations, reduce your exposure to price volatility, and unlock global opportunities without putting strain on your working capital. 5 Steps to Leverage Trade Finance in Oil & Gas Step 1: Use Letters of Credit to Ensure Timely and Secure Transactions Letters of Credit (LCs) are essential in oil and gas, where deals often involve unknown parties and high-value transactions. LCs guarantee payment to the exporter upon meeting delivery conditions, offering security to both sides. How to implement: • Work with a bank to issue a confirmed LC before finalizing a deal. • Ensure all documentary conditions are clearly defined (e.g., bills of lading, inspection certificates). • Use LCs to negotiate better terms with international buyers or sellers. Step 2: Mitigate Risk with Performance and Advance Payment Guarantees Large-scale projects often require upfront payments or assurance of performance. Performance guarantees ensure the job gets done, while advance payment guarantees protect buyer prepayments. How to implement: • Use advance payment guarantees when suppliers require deposits. • Request performance guarantees from contractors to ensure timelines are met. • Clearly define deliverables and triggers in guarantee documents to avoid ambiguity. Step 3: Stabilize Cash Flow with Supply Chain Finance Given the long payment cycles in oil and gas, suppliers often struggle with cash flow. Supply chain finance allows them to get paid early without impacting your liquidity. How to implement: • Partner with a trade finance provider that offers supplier payment programs. • Extend your payables while letting your vendors receive immediate funds. • Use this tool to improve supplier loyalty and reduce operational risk. Step 4: Hedge Against Volatility with Structured Trade Finance Solutions Price swings in oil and gas markets can erode margins quickly. Structured trade finance solutions—like revolving credit facilities linked to inventory or receivables—can offer flexibility and stability. How to implement: • Work with your financier to tailor a structure that aligns with your cash cycle. • Use receivables or stored inventory as collateral. • Negotiate revolving terms to access funding repeatedly over time. Step 5: Navigate Sanctions and Compliance with Expert Support Cross-border oil and gas deals often involve jurisdictions with complex regulations and potential sanctions. Non-compliance can be disastrous. How to implement: • Engage a trade finance provider familiar with international compliance requirements. • Vet counterparties through sanctions screening and due diligence. • Request documentation and contracts to be reviewed for regulatory red flags. The oil and gas sector demands speed, security, and precision in every deal. At Trade Finance Company, we specialize in helping energy businesses thrive in complex global environments. From letters of credit to performance guarantees, we structure trade finance solutions that match your unique needs. Email: info@tradefinancecompany.co Call: +65 3105 1500 Contact us today and gain the financial confidence to power your next big oil and gas deal.

Bank Guarantees Explained: How They Protect and Strengthen Business Deals

How Trade Finance Supports Global Supply Chains The smooth functioning of global supply chains is critical for economic growth, production continuity, and customer satisfaction. Trade finance acts as the backbone of these supply chains—facilitating timely payments, ensuring trust among trading partners, and enabling companies to procure raw materials and deliver goods across continents without disrupting cash flow. Without trade finance, global supply chains would be more fragile, expensive, and unreliable. Image by Freepik By reading this blog, you’ll understand the essential role trade finance plays in strengthening and sustaining global supply chains. You’ll discover how it empowers businesses to reduce risk, maintain liquidity, and build stronger international relationships—all of which lead to better resilience and competitive advantage in today’s unpredictable global markets. Picture a factory in Asia that relies on raw materials from Europe and sells finished products in North America. A delay in payment from one client or a bottleneck in procurement could bring the entire production line to a halt. For thousands of businesses like this one, trade finance is more than a tool—it’s a lifeline. It brings the assurance that suppliers will be paid on time and buyers will receive goods as agreed, even when economic conditions are uncertain. “Trade finance is the grease that keeps the gears of global supply chains moving. Without it, trust would break down and trade would slow to a crawl.” — James Kim, International Supply Chain Strategist In the next sections, you’ll explore exactly how trade finance supports every link of the supply chain—from procurement to final delivery. You’ll learn about the tools and strategies businesses can adopt to keep inventory moving, avoid payment disputes, and protect working capital. Most importantly, you’ll gain actionable tips on how to use trade finance to stabilize your operations and expand your business reach without bearing unnecessary financial risk. 5 Key Steps to Strengthen Your Supply Chain with Trade Finance Step 1: Use Letters of Credit to Build Trust Across Borders Letters of Credit (LCs) are among the most reliable trade finance instruments that ensure payment upon compliance with agreed terms. This builds confidence between exporters and importers, even if they’ve never worked together before. How to implement: • Ask your bank or trade finance provider to issue or confirm an LC when entering into international contracts. • Make sure all terms (like shipping dates and document requirements) are clearly defined in the LC. • Work closely with your suppliers to ensure they understand and meet the documentary requirements for prompt payment. Step 2: Improve Cash Flow with Supply Chain Financing Supply chain finance (also known as reverse factoring) allows suppliers to receive early payments based on the creditworthiness of the buyer, freeing up much-needed cash without taking on debt. How to implement: • Talk to your finance partner about setting up a supply chain finance program for your key vendors. • Use it to help smaller or cash-strapped suppliers who might struggle with long payment terms. • Leverage early payment discounts while maintaining your own liquidity and payment schedule. Step 3: Use Performance Guarantees to Ensure Contract Fulfillment Performance guarantees reassure the buyer that the supplier will meet the contract terms. If not, the guarantee compensates the buyer, minimizing risk and avoiding disruption. How to implement: • Request or issue a performance guarantee before large or long-term trade contracts. • Use these guarantees to secure better contract terms and avoid legal disputes in case of non-performance. • Choose a financial institution with a solid reputation for issuing enforceable guarantees worldwide. Step 4: Implement Advance Payment Guarantees for Confidence in Prepayments In some cases, buyers are asked to pay in advance for raw materials or production costs. Advance payment guarantees protect buyers by ensuring that if the seller fails to deliver, the advance will be refunded. How to implement: • When paying suppliers upfront, always request an advance payment guarantee. • Include specific milestones and refund triggers to ensure accountability. • Keep a copy of the guarantee readily accessible in case of any delivery issues. Step 5: Secure Inventory with Stock Finance Solutions Stock finance (inventory financing) helps you hold and manage inventory without putting strain on your cash flow. This is especially helpful when goods are in transit or stored in warehouses before being sold. How to implement: • Partner with a trade finance company that offers stock financing to free up working capital. • Use inventory reports to show the value of stock and qualify for financing. • Monitor the turnover rate and storage costs to ensure financing stays cost-effective. A strong supply chain starts with strong financial support. Whether you’re managing complex imports, looking to support suppliers, or want to improve cash flow, Trade Finance Company can help. Let us tailor the right trade finance solutions to your needs and keep your supply chain moving—no matter where you do business. Email: info@tradefinancecompany.co Call: +65 3105 1500 Need advice on letters of credit, inventory finance, or supplier payment options? Contact us today and speak with a trade finance expert. → Contact us today to explore your trade finance options and grow globally with confidence!

Case Study: $4.7M in Construction Guarantees for a Major Wastewater Treatment Project in Central Asia Issued in Just 7 Days

Case Study: $4.7M in Construction Guarantees for a Major Wastewater Treatment Project in Central Asia Issued in Just 7 Days Learn how Trade Finance Company delivered an Advance Payment Guarantee and a Performance Guarantee, totaling over $4.74 million to support a transformative infrastructure project in Central Asia within just 7 days. Request Your Estimates Today! Abstract This case study explores how Trade Finance Company facilitated two critical financial instruments—a $3.16M Advance Payment Guarantee and a $1.58M Performance Guarantee—to support a major construction contract in Central Asia. The guarantees were instrumental in enabling a high-impact infrastructure project: the construction of a state-of-the-art Wastewater Treatment Plant (WWTP) in Central Asia. This case demonstrates how tailored trade finance solutions can drive progress on essential public works while minimizing project and payment risk. By delivering tailored guarantees quickly and securely, we enabled the client to maintain credibility with their project stakeholders and meet international compliance standards. Introduction In large-scale infrastructure projects, construction companies often need to provide financial guarantees to demonstrate reliability and commitment. These guarantees help satisfy the employer’s risk management needs, especially when substantial prepayments or performance benchmarks are involved. Infrastructure development projects, especially those in the public utility sector, require not just capital and expertise but also robust financial backing to ensure project security and stakeholder confidence. A client from Central Asia reached out to Trade Finance Company to provide essential financial guarantees required under a significant public works contract. With construction schedules and public services on the line, speed and precision were critical. The guarantees were required for the successful execution of a major public infrastructure project: the Construction of a Wastewater Treatment Plant (WWTP) in Central Asia. The existing facility in the area is currently non-operational. This project aims to transform the outdated site into a modern WWTP capable of processing up to 20,000 m³ of wastewater per day, ultimately delivering centralized, reliable wastewater services to an estimated population of 100,000 residents in the region. Time was critical: the project schedule demanded prompt issuance of the instruments to prevent delays in mobilization and execution. Challenges The client faced several key challenges: Compliance with Contractual Terms: The construction contract required both an advance payment guarantee and a performance guarantee to be issued before mobilization could begin. Time Constraints: Issuance needed to occur within a tight timeframe to align with funding and operational deadlines. Multiple Draft Revisions: Both guarantees required multiple rounds of revisions to meet both employer and local compliance standards. Coordination of Dual Instruments: Issuing two separate instruments in parallel required close coordination and real-time communication between all stakeholders. Solutions To meet the client’s requirements, Trade Finance Company developed a three-pronged solution: Instrument Structuring: We customized an Advance Payment Guarantee of $3,160,402.94 and a Performance Guarantee of $1,580,201.47, ensuring both complied with international banking norms and the specific requirements of the project employer. Rapid Coordination: By working in tandem with Asia Nexus and legal counsel, we aligned the drafts with all regulatory and contractual obligations across several rounds of revision. Secure Issuance Framework: All instruments were processed through established banking channels, ensuring transparency, traceability, and full compliance. Solution Implementation The process began with initial drafts provided by the beneficiary bank, which kicked off a collaborative review and revision period. Between April 10 and May 20, 2025, multiple revised drafts of both the Advance Payment Guarantee and the Performance Guarantee were exchanged to ensure full alignment with the client’s contract terms and the employer’s requirements. On May 22, 2025, the signed drafts were received, followed by proof of the pre-issuance fee on May 23, with payment clearing into the account by May 27. The final documents were then sent for issuance on May 29, and by May 30, 2025, both relayed copies of the financial guarantees were successfully delivered to the client — completing the entire transaction within just 7 days from payment receipt. Results By the end of the 7-day execution period, the client had in hand:• A $3,160,402.94 Advance Payment Guarantee• A $1,580,201.47 Performance GuaranteeThese results delivered immediate and long-term benefits: Transaction Completed in 7 Days: Both guarantees were issued within a week of receiving payment, enabling the project to proceed on schedule. Full Compliance Achieved: Instruments were accepted by the employer without further modification, reflecting the accuracy and quality of documentation. Support for a High-Impact Public Project: The client secured the necessary financial backing to begin construction on a facility that will improve sanitation infrastructure for over 100,000 people. Strengthened Credibility: The timely issuance and compliance of the guarantees strengthened the client’s position with the employer and enhanced their profile for future tenders. Discussion This case demonstrates how well-coordinated financial structuring and expertise in trade instruments can make or break complex project timelines. Whether for public infrastructure or private development, guarantees like these serve as vital tools for securing trust, managing risk, and enabling project financing. Trade Finance Company’s ability to issue two large instruments under tight deadlines showcases our commitment to helping clients deliver results — even under pressure. Conclusion This case highlights Trade Finance Company’s role as a trusted partner in facilitating complex, high-stakes infrastructure projects. By delivering both an Advance Payment Guarantee and a Performance Guarantee within just 7 days, we empowered our client to meet contractual obligations and initiate a transformative wastewater treatment project in Central Asia. Our expertise, speed, and attention to detail ensured the success of this mission-critical transaction. Get In touch! Are you facing challenges in securing financial instruments for your trade transactions? Let Trade Finance Company design a solution that meets your specific needs. Contact us today to unlock new opportunities in global trade. Get In touch! Need performance or advance guarantees for your next project? Contact Trade Finance Company today! Let us help you deliver with speed, security, and confidence.

Case Study: $4.74M in Construction Guarantees Issued in Just 7 Days

Case Study: $4.74M in Construction Guarantees Issued in Just 7 Days Learn how Trade Finance Company delivered an Advance Payment Guarantee and a Performance Guarantee, totaling over $4.74 million, to support a high-value construction project in Central Asia — all within 7 days of payment confirmation. Request Your Estimates Today! Abstract This case study highlights how Trade Finance Company issued two essential financial instruments — a $3.16M Advance Payment Guarantee and a $1.58M Performance Guarantee — for a client in Central Asia to support a major construction contract. These guarantees were processed, issued, and delivered within just 7 days from payment receipt, ensuring the client could meet contractual obligations and move forward with the project on time. By delivering tailored guarantees quickly and securely, we enabled the client to maintain credibility with their project stakeholders and meet international compliance standards. Introduction In large-scale infrastructure projects, construction companies often need to provide financial guarantees to demonstrate reliability and commitment. These guarantees help satisfy the employer’s risk management needs, especially when substantial prepayments or performance benchmarks are involved. A client from Central Asia approached Trade Finance Company with the urgent requirement for both an Advance Payment Guarantee and a Performance Guarantee, aligned with a multimillion-dollar construction contract. Time was critical: the project schedule demanded prompt issuance of the instruments to prevent delays in mobilization and execution. Challenges The client faced several key challenges: Dual Instrument Requirement: Both an Advance Payment Guarantee and a Performance Guarantee were required — each with specific wording and conditions tied to the contract. Tight Timelines: Delays in delivering the guarantees could jeopardize project timelines and funding disbursements. Strict Compliance Requirements: The wording of the guarantees had to meet employer standards and pass legal review, necessitating multiple revisions. Solutions To meet these demands, Trade Finance Company implemented a streamlined, collaborative, and compliant process: Customized Drafting & Negotiation: We worked closely with the client and their legal team to prepare and revise the guarantee drafts until final acceptance. Parallel Structuring: Both instruments were developed concurrently, ensuring no time was lost waiting for separate reviews. Speed & Accuracy: Once payment was confirmed, we prioritized execution and issuance to ensure both guarantees were delivered in just 7 days. Solution Implementation The process began with initial drafts provided by Asia Nexus, which kicked off a collaborative review and revision period. Between April 10 and May 20, 2025, multiple revised drafts of both the Advance Payment Guarantee and the Performance Guarantee were exchanged to ensure full alignment with the client’s contract terms and the employer’s requirements. On May 22, 2025, the signed drafts were received, followed by proof of the pre-issuance fee on May 23, with payment clearing into the account by May 27. The final documents were then sent for issuance on May 29, and by May 30, 2025, both relayed copies of the financial guarantees were successfully delivered to the client — completing the entire transaction within just 7 days from payment receipt. Results By the end of the 7-day execution period, the client had in hand: • A $3,160,402.94 Advance Payment Guarantee • A $1,580,201.47 Performance Guarantee These results delivered immediate and long-term benefits: On-Time Project Mobilization: The guarantees enabled the client to unlock prepayment funds and start work without delay. Compliance and Trust: Employer requirements were fully met, ensuring continued trust and credibility. Efficient Execution: Trade Finance Company demonstrated agility and professionalism, handling both instruments simultaneously without compromise. Discussion This case demonstrates how well-coordinated financial structuring and expertise in trade instruments can make or break complex project timelines. Whether for public infrastructure or private development, guarantees like these serve as vital tools for securing trust, managing risk, and enabling project financing. Trade Finance Company’s ability to issue two large instruments under tight deadlines showcases our commitment to helping clients deliver results — even under pressure. Conclusion The successful delivery of over $4.74 million in construction guarantees in just 7 days reinforces Trade Finance Company’s position as a trusted partner for businesses engaged in high-value contracts. Get In touch! Need performance or advance guarantees for your next project? Contact Trade Finance Company today! Let us help you deliver with speed, security, and confidence.

How Trade Finance Supports Global Supply Chains

How Trade Finance Supports Global Supply Chains The smooth functioning of global supply chains is critical for economic growth, production continuity, and customer satisfaction. Trade finance acts as the backbone of these supply chains—facilitating timely payments, ensuring trust among trading partners, and enabling companies to procure raw materials and deliver goods across continents without disrupting cash flow. Without trade finance, global supply chains would be more fragile, expensive, and unreliable. Image by Freepik By reading this blog, you’ll understand the essential role trade finance plays in strengthening and sustaining global supply chains. You’ll discover how it empowers businesses to reduce risk, maintain liquidity, and build stronger international relationships—all of which lead to better resilience and competitive advantage in today’s unpredictable global markets. Picture a factory in Asia that relies on raw materials from Europe and sells finished products in North America. A delay in payment from one client or a bottleneck in procurement could bring the entire production line to a halt. For thousands of businesses like this one, trade finance is more than a tool—it’s a lifeline. It brings the assurance that suppliers will be paid on time and buyers will receive goods as agreed, even when economic conditions are uncertain. “Trade finance is the grease that keeps the gears of global supply chains moving. Without it, trust would break down and trade would slow to a crawl.” — James Kim, International Supply Chain Strategist In the next sections, you’ll explore exactly how trade finance supports every link of the supply chain—from procurement to final delivery. You’ll learn about the tools and strategies businesses can adopt to keep inventory moving, avoid payment disputes, and protect working capital. Most importantly, you’ll gain actionable tips on how to use trade finance to stabilize your operations and expand your business reach without bearing unnecessary financial risk. 5 Key Steps to Strengthen Your Supply Chain with Trade Finance Step 1: Use Letters of Credit to Build Trust Across Borders Letters of Credit (LCs) are among the most reliable trade finance instruments that ensure payment upon compliance with agreed terms. This builds confidence between exporters and importers, even if they’ve never worked together before. How to implement: • Ask your bank or trade finance provider to issue or confirm an LC when entering into international contracts. • Make sure all terms (like shipping dates and document requirements) are clearly defined in the LC. • Work closely with your suppliers to ensure they understand and meet the documentary requirements for prompt payment. Step 2: Improve Cash Flow with Supply Chain Financing Supply chain finance (also known as reverse factoring) allows suppliers to receive early payments based on the creditworthiness of the buyer, freeing up much-needed cash without taking on debt. How to implement: • Talk to your finance partner about setting up a supply chain finance program for your key vendors. • Use it to help smaller or cash-strapped suppliers who might struggle with long payment terms. • Leverage early payment discounts while maintaining your own liquidity and payment schedule. Step 3: Use Performance Guarantees to Ensure Contract Fulfillment Performance guarantees reassure the buyer that the supplier will meet the contract terms. If not, the guarantee compensates the buyer, minimizing risk and avoiding disruption. How to implement: • Request or issue a performance guarantee before large or long-term trade contracts. • Use these guarantees to secure better contract terms and avoid legal disputes in case of non-performance. • Choose a financial institution with a solid reputation for issuing enforceable guarantees worldwide. Step 4: Implement Advance Payment Guarantees for Confidence in Prepayments In some cases, buyers are asked to pay in advance for raw materials or production costs. Advance payment guarantees protect buyers by ensuring that if the seller fails to deliver, the advance will be refunded. How to implement: • When paying suppliers upfront, always request an advance payment guarantee. • Include specific milestones and refund triggers to ensure accountability. • Keep a copy of the guarantee readily accessible in case of any delivery issues. Step 5: Secure Inventory with Stock Finance Solutions Stock finance (inventory financing) helps you hold and manage inventory without putting strain on your cash flow. This is especially helpful when goods are in transit or stored in warehouses before being sold. How to implement: • Partner with a trade finance company that offers stock financing to free up working capital. • Use inventory reports to show the value of stock and qualify for financing. • Monitor the turnover rate and storage costs to ensure financing stays cost-effective. A strong supply chain starts with strong financial support. Whether you’re managing complex imports, looking to support suppliers, or want to improve cash flow, Trade Finance Company can help. Let us tailor the right trade finance solutions to your needs and keep your supply chain moving—no matter where you do business. Email: info@tradefinancecompany.co Call: +65 3105 1500 Need advice on letters of credit, inventory finance, or supplier payment options? Contact us today and speak with a trade finance expert. → Contact us today to explore your trade finance options and grow globally with confidence!

Standby Letters of Credit: The Ultimate Business Safety Net for Trade Transactions

Standby Letters of Credit: The Ultimate Business Safety Net for Trade Transactions Trust isn’t just a virtue in international trade—it’s the foundation that holds transactions together. Standby Letters of Credit (SBLCs) have become essential financial instruments, offering a dependable means to guarantee both payment and performance in cross-border dealings. By acting as a financial safety net, SBLCs significantly reduce risk and foster stronger, more confident relationships between global buyers and sellers. Image by rawpixel.com on Freepik In this blog, you’ll discover how Standby Letters of Credit can protect your business from financial loss, ensure smooth international transactions, and position your company as a trustworthy player in global trade. If you’re looking for a way to reduce risk and build solid trade relationships, this article is for you. Imagine this: You’ve just secured a major international contract. The opportunity is huge, but you’re wary—what if the other party doesn’t follow through? What if payment is delayed or never arrives? These fears are real, especially for growing businesses. Standby Letters of Credit provide peace of mind. They act like a financial safety net, assuring you that you won’t be left empty-handed. “A Standby Letter of Credit is not just a promise—it’s a financial shield. It ensures that trust, even across oceans, has backing.” — Global Trade Expert, Carla Mendoza By the end of this blog, you’ll gain a clear understanding of what Standby Letters of Credit are, how they work in real trade transactions, and how to practically incorporate them into your business strategy. You’ll also learn step-by-step tips to effectively leverage SBLCs for maximum protection and business growth. Whether you’re a new exporter or a seasoned trader, this guide will empower you with actionable knowledge to safeguard your interests. 5 Key Steps to Leverage SBLCs Effectively Step 1: Understand the Types of SBLCs and Choose the Right One There are two main types of SBLCs—financial and performance. A financial SBLC ensures payment in case of non-payment by the buyer, while a performance SBLC guarantees the fulfillment of a contract’s terms. How to implement: • Analyze your business needs: Are you more concerned about getting paid or ensuring service delivery? • Consult your trade finance advisor or banker to determine the appropriate SBLC type. • Always define the SBLC terms clearly in the contract to avoid misunderstandings later. Step 2: Work with a Reputable Bank or Trade Finance Partner Not all financial institutions provide efficient SBLC services. Choosing the right partner can make or break your experience. How to implement: • Look for institutions experienced in international trade finance. • Check their turnaround time, fees, global network, and track record. • Ensure the bank is familiar with SWIFT communications and can issue or confirm SBLCs efficiently. Step 3: Clearly Define Conditions and Documentation Ambiguities in SBLC terms can lead to disputes or payment refusal. The issuing bank will only release funds if the beneficiary complies exactly with the stipulated terms. How to implement: • Work with legal and finance experts to draft precise, unambiguous SBLC terms. • Define performance metrics, timelines, shipping documentation, and any required certifications. • Keep all documents in a well-organized system for swift presentation upon need. Step 4: Use SBLCs to Strengthen Negotiation Power An SBLC provides assurance not just for you, but also for your counterpart. It can help you negotiate better prices, longer payment terms, or gain access to more suppliers. How to implement: • Mention in your negotiations that your obligations are backed by an SBLC. • Use it to reassure partners who may otherwise hesitate due to distance or unfamiliarity. • Emphasize that the SBLC ensures a win-win situation—both parties are protected. Step 5: Regularly Review and Renew Your SBLC Strategy Markets evolve, and so do risks. The way you use SBLCs should adapt to your growing business needs and external trade conditions. How to implement: • Conduct periodic reviews of all SBLCs in place—expiration dates, conditions, and bank reliability. • Update your staff on SBLC handling and compliance. • Ask your financial advisor how to integrate SBLCs with other instruments like bank guarantees or letters of credit for broader protection. Trade finance has come a long way—and your business can be part of its next evolution. Whether you’re navigating your first international transaction or expanding across borders, Trade Finance Company is here to guide you. We offer personalized support and robust financial instruments that help you trade with confidence. Call: +1 858 848 0909 Email: info@tradefinancecompany.co Visit: www.tradefinancecompany.co → Contact us today to explore your trade finance options and grow globally with confidence!

The History and Evolution of Trade Finance

The History and Evolution of Trade Finance Trade finance has been the unsung backbone of international commerce for centuries. From ancient trade routes and merchant-led barter systems to today’s sophisticated financial instruments, trade finance has evolved in tandem with globalization, economic revolutions, and technological advancements. Understanding its historical development not only adds depth to our appreciation of global trade but also highlights how critical financial innovation is to economic progress. Image by freepik Get ready to explore how trade finance evolved from handwritten promissory notes to today’s structured instruments like Letters of Credit and Bank Guarantees. This blog will give you insights into the past, show you how it shaped modern finance, and reveal how this knowledge can inform smarter trade decisions today. Let’s paint a picture: being a silk trader along the ancient Silk Road, carrying precious goods across continents with no banks, no guarantees, and no financial protection. Every transaction was built on trust and risk. Fast forward to today—thanks to centuries of evolution, we now enjoy secure, structured financial instruments that reduce risk and increase trade confidence. Understanding this journey isn’t just historical curiosity—it reminds us that trade finance is a human story of innovation, trust, and resilience. “Trade finance is not just about money—it’s about trust and structure that made world trade possible.” — Richard Burnett, International Trade Historian In this article, you’ll gain a deep understanding of the historical milestones that shaped trade finance—from its origins in ancient civilizations, through the merchant banking era of the Renaissance, to the institutional systems of the 20th and 21st centuries. You’ll discover how each development addressed unique trade challenges of its time and how those lessons still impact modern trade instruments. By the end, you’ll not only understand where trade finance came from—but why it continues to matter more than ever today. 5 Key Lessons from Trade Finance History 1. Strengthen Relationships to Build Long-Term Trade Success Throughout history, trusted relationships formed the bedrock of trade. Before formal contracts and banking systems, merchants relied on personal trust, word of mouth, and honor-based agreements. These values remain just as important today. How to apply it today: • Foster strong communication with your suppliers and buyers. Regular check-ins and transparent discussions can preempt many disputes. • Engage in relationship-building beyond the transaction. Attend trade events or industry forums to create a network of trusted partners. • Offer reliability—be punctual with payments and fulfill your commitments. Reputation still travels fast in trade circles. 2. Utilize Time-Tested Instruments Like Letters of Credit Letters of Credit (LCs) date back to the Renaissance and have stood the test of time for good reason—they protect both buyers and sellers. Even in the modern age, they remain one of the most trusted instruments in international trade. How to apply it today: • Use LCs when trading with unfamiliar or overseas partners. They ensure payment is only made when conditions are met. • Work closely with your bank to understand the specific LC types that suit your trade needs (e.g., Confirmed LC, Revolving LC). • Educate your trade team on LC documentation to avoid delays caused by compliance issues or incorrect paperwork. 3. Break Down Risk Through Structured Trade Agreements Just as early traders used multiple caravans and shipping points to reduce loss risk, modern businesses should structure trade deals to protect themselves against financial and logistical uncertainties. How to apply it today: • Use milestone-based payments or partial shipments when dealing with large orders. • Include penalty and exit clauses in contracts to handle delays or quality issues. • Protect yourself with performance guarantees and credit insurance when entering high-value deals. 4. Leverage Institutional Partnerships for Trade Confidence Since the 14th century, trade finance institutions—from merchant banks to modern commercial banks—have provided critical trust, liquidity, and security for cross-border commerce. How to apply it today: • Choose financial institutions with a proven track record in trade finance. Look for those who offer flexible instruments and strong international networks. • Discuss financing options like Standby Letters of Credit, Advance Payment Guarantees, or Performance Bonds. • Use advisory services from these institutions to stay compliant with global trade regulations and optimize your transaction flow. 5. Stay Proactive by Learning from the Past Trade finance is a dynamic field shaped by history, innovation, and global events. Being aware of historical trade disruptions—like war, pandemics, or economic collapse—can help businesses build resilience into their strategies. How to apply it today: • Develop contingency plans for supply chain disruptions or payment failures. • Regularly review and update your contracts to reflect changing economic realities. • Educate yourself and your team on evolving financial instruments by reading industry whitepapers, case studies, or attending webinars. Trade finance has come a long way—and your business can be part of its next evolution. Whether you’re navigating your first international transaction or expanding across borders, Trade Finance Company is here to guide you. We offer personalized support and robust financial instruments that help you trade with confidence. Call: +1 858 848 0909 Email: info@tradefinancecompany.co Visit: www.tradefinancecompany.co → Contact us today to explore your trade finance options and grow globally with confidence! Call us now or send us an inquiry to discuss your needs.

How Letters of Credit Empower Global Trade: A Reliable Tool for Business Security

How Letters of Credit Empower Global Trade: A Reliable Tool for Business Security In the world of international trade, where buyers and sellers often operate oceans apart, trust is everything. A Letter of Credit (LC) acts as a vital bridge of security between trading partners, offering a financial guarantee that the buyer will pay the seller on time and in full—provided the terms are met. This trusted instrument has empowered global commerce for decades by reducing risk, ensuring payment, and enabling businesses to trade confidently across borders. Image by drobotdean on Freepik In this week’s article, you’ll learn how Letters of Credit can protect your business, unlock new markets, and ensure smooth international transactions—even when trading partners are unfamiliar or geopolitical risks are high. Imagine shipping your goods overseas only to discover the buyer refuses to pay—or worse, disappears. It’s every exporter’s nightmare. Letters of Credit remove that fear by ensuring the payment is secured by a trusted financial institution, not the word of a distant partner. For importers, it means they don’t have to pay until the seller fulfills their part of the deal. This mutual protection builds trust, confidence, and the freedom to grow globally without second-guessing every deal. “Letters of Credit are the heartbeat of international trade—they bring trust to transactions where uncertainty once ruled.” — Elena Ruiz, Global Trade Finance Expert By reading this blog, you’ll gain a solid understanding of how Letters of Credit work and why they’re a cornerstone of global trade. We’ll walk you through their key benefits, including risk mitigation, payment assurance, and improved cash flow. You’ll also learn how to practically implement LCs in your trade deals, whether you’re an exporter or importer. Most importantly, you’ll discover how using LCs can give your business the confidence and leverage it needs to expand internationally while minimizing exposure to fraud or non-payment. 1. Evaluate the Risk Level of Your Trade Partner Beforehand Before even applying for a Letter of Credit, assess the risk involved with the country, company, and industry you’re dealing with. The more volatile or unfamiliar the market, the more critical it is to protect your transactions with an LC. How to do it: • Conduct due diligence through online trade directories, government export resources, or credit reports. • Consider the political and economic stability of your partner’s country. • Use tools like the OECD country risk classification or speak to a trade finance advisor for a professional risk evaluation. 2. Choose the Right Type of Letter of Credit Different trade scenarios require different LC types. Selecting the correct LC for your transaction structure can improve cash flow, protect delivery timelines, and prevent disputes. How to do it: • Sight LC: Use this when you need fast payment upon shipping and document submission. • Usance LC: Opt for this if your buyer needs time to make payments, offering better flexibility. • Confirmed LC: Ideal when the buyer is in a high-risk country—you’ll have a local bank backing the guarantee. • Revolving LC: Useful for long-term contracts with repeated shipments. Discuss your trade terms with your finance provider to match the right LC with your needs. 3. Ensure Precision in Documentation The success of an LC heavily depends on your ability to submit the exact documents required under the agreed terms. Even small errors—misspellings, inconsistent dates, or missing signatures—can result in payment delays or rejections. How to do it: • Make a checklist of all required documents (e.g., invoice, packing list, bill of lading, insurance, certificate of origin). • Have an experienced trade documentation professional or freight forwarder review your documents. • Double-check that all data is consistent across every document submitted to the bank. 4. Set Realistic Timelines and Clarify Terms Early Delays in shipping, customs clearance, or document submission can affect LC compliance. Make sure you and your trade partners are on the same page from the beginning. How to do it: • Clarify who handles what—document preparation, freight, insurance, etc.—during the negotiation phase. • Agree on shipping windows, expiration dates of the LC, and any grace periods. • Work backward from the LC expiry date to establish internal deadlines for each document. 5. Work with an Experienced Trade Finance Provider Not all banks or institutions offer the same level of trade finance support. A seasoned provider can help structure your LC, communicate with advising or confirming banks, and troubleshoot any issues that arise during the transaction. How to do it: • Partner with a provider that has global experience and a responsive team. • Ask questions about fees, turnaround time, and documentation requirements. • Build a relationship with your trade finance consultant—they can help tailor solutions and offer updates on regulatory changes. Ready to secure your international transactions with confidence? At Trade Finance Company, we specialize in Letters of Credit and other trade finance instruments designed to protect your business and help it thrive globally. Whether you’re an importer or exporter, we’re here to guide you every step of the way. Call us today to discuss your trade needs Or email us at info@tradefinancecompany.co for a free consultation Call us now or send us an inquiry to discuss your needs.

The Impact of Global Economic Uncertainty on Trade Finance in 2025

The Impact of Global Economic Uncertainty on Trade Finance in 2025 The year 2025 has brought with it a wave of global economic turbulence—ranging from inflation spikes and geopolitical instability to fluctuating interest rates and fragile supply chains. For businesses engaged in cross-border trade, these uncertainties have a direct impact on financial planning and access to trade finance. Now, more than ever, importers and exporters must rely on trusted financial instruments to maintain operations and mitigate risks. Image by freepik In this article, you’ll discover how to strategically protect your business using proven trade finance tools amid economic uncertainty. We’ll share expert-backed insights that can help you reduce financial risk, maintain liquidity, and strengthen your trade partnerships—no matter what 2025 throws your way. Economic instability isn’t just a macroeconomic buzzword—it’s what you feel when your trusted buyer defaults, when your supplier increases prices overnight, or when your bank suddenly tightens credit terms. For many business owners, trade finance is the safety net that allows them to keep moving forward. In a climate where volatility has become the new normal, having access to reliable, structured trade finance solutions is not a luxury—it’s a necessity for survival and growth. “Global uncertainty challenges us, but it also forces us to become smarter, leaner, and more resilient—especially when it comes to trade finance.” — Samuel Goh, International Trade Economist This article will help you understand the impact of current global economic challenges on trade finance in 2025 and what that means for your business. You’ll learn how to diversify your funding sources, manage currency risks, and protect yourself from counterparty defaults. We’ll provide practical, actionable tips you can implement immediately to keep your cash flow strong and your supply chains steady—even in the face of rising uncertainty. If you want to make smart decisions about financing your imports and exports this year, you’re in the right place. 1. Diversify Your Trade Finance Partners Relying on just one financial institution can backfire in uncertain times. If that bank reduces exposure or changes its risk appetite, your business could be left scrambling. By working with multiple providers—including trade finance companies and reputable intermediaries—you improve your access to capital and reduce the chance of sudden disruptions in financing. How to do it: • Reach out to trade finance firms that offer flexible solutions tailored to your region or sector. • Maintain strong communication with all financial partners to stay ahead of policy changes. • Consider using tools like standby letters of credit, bank guarantees, and advance payment guarantees from multiple providers. 2. Hedge Against Currency Volatility With exchange rates fluctuating daily, exporters and importers can quickly lose margins. Currency risk is one of the most overlooked threats to profitability in global trade. Securing protection against it is essential for long-term planning. How to do it: • Lock in exchange rates for major transactions using forward contracts or currency swaps offered by your bank. • Build price flexibility into your contracts to account for currency changes. • Evaluate currency exposures monthly and work with your financial advisor to adjust your strategy accordingly. 3. Vet Your Buyers and Suppliers Thoroughly In economic downturns, the risk of default or fraud increases significantly. A buyer might delay payment, or a supplier might fail to deliver. Ensuring you’re doing business with credible partners is critical. How to do it: • Use bank-issued instruments like performance guarantees or letters of credit to secure transactions. • Request background checks and trade references before entering new deals. • Set up clear payment terms and secure them with financial guarantees when possible. 4. Build a Financial Cushion with Pre-Approved Instruments When economic shocks hit, having ready access to financing can make or break your ability to fulfill contracts or seize new opportunities. Having pre-approved trade finance instruments in place allows you to act fast. How to do it: • Apply in advance for standby letters of credit or bank guarantees to have them ready when needed. • Work with a trade finance partner that can issue proof of funds or ready, willing, and able (RWA) letters on short notice. • Avoid last-minute financing, which often comes with unfavorable terms. 5. Reassess and Strengthen Your Risk Mitigation Strategy Every business needs a tailored risk strategy that reflects the current economic climate. Now is the time to assess vulnerabilities in your trade finance process. How to do it: • Review all trade agreements and include stronger force majeure or dispute resolution clauses. • Make use of tender guarantees and advance payment guarantees when entering government or large-scale contracts. • Stay in constant contact with your trade finance advisor to review potential exposure regularly. Uncertainty may be unavoidable—but being unprepared isn’t. Partner with Trade Finance Company today and let our experienced team guide you through 2025 with confidence. We offer a wide range of trade finance instruments designed to help you thrive in uncertain times. Let’s turn uncertainty into opportunity—together. Call us now or send us an inquiry to discuss your needs.

Fraud Prevention in Trade Finance: Tips for Businesses

Fraud Prevention in Trade Finance: Tips for Businesses Fraud in trade finance is a growing concern, costing businesses billions globally each year. From forged documents to fake companies and phishing scams, the complex nature of international trade creates ample opportunity for fraudsters. The good news? With the right strategies and tools, businesses can significantly reduce their exposure to risk and operate with greater confidence in the global market. Image by freepik In this blog, you’ll discover practical, proven strategies to prevent trade finance fraud, safeguard your business, and build trust with international partners. Whether you’re a seasoned exporter or just stepping into the global trade space, the insights here will empower you to detect red flags early and implement solid fraud prevention protocols. Just imagine closing what appears to be a lucrative trade deal, only to realize weeks later that the buyer never existed, the documents were forged, and your goods are lost in transit. The financial and emotional toll of trade fraud can be devastating—not just for your balance sheet but also for the reputation and future of your business. The truth is, no company is too small to be targeted, and vigilance is your strongest line of defense. Knowing what to look for—and what steps to take—can mean the difference between success and a very costly mistake. “In trade finance, trust is everything—but blind trust is dangerous. Fraudsters exploit complexity, so your best defense is knowledge, verification, and proactive protection.” — Amit Malhotra, Global Trade Risk Analyst In the following sections, you’ll gain a clear understanding of the most common types of trade finance fraud and the steps you can take to prevent them. You’ll learn how to identify red flags, establish verification protocols, and adopt secure digital practices that will help keep your transactions legitimate and secure. These easy-to-follow tips will guide you in creating a culture of vigilance and accountability—protecting your finances, partners, and global trade operations. 1. Verify All Counterparties Thoroughly Before entering into any trade agreement, conduct due diligence on the other party. Check their business registration, look up their credit rating, and request references. If the company is based overseas, consider hiring a local agent or third-party verifier to confirm their legitimacy. How to Achieve It: • Use trade directories and government resources to confirm business authenticity. • Look for red flags such as lack of verifiable contact information or inconsistent records. • Don’t rely solely on email; request video calls and live walkthroughs of their premises when possible. 2. Secure All Documents and Communications Fraud often starts with forged documents or intercepted communication. Ensure that all trade documents, contracts, and payment instructions are digitally secured and verified. Avoid sharing sensitive information via unsecured email systems. How to Achieve It: • Use secure document exchange platforms or encrypted communication tools. • Implement a digital document verification system such as blockchain or document fingerprinting. • Train your staff to recognize phishing attempts and avoid clicking on suspicious links or downloading unknown files. 3. Insist on Independent Third-Party Inspections Don’t rely on the seller’s word alone when dealing with unfamiliar or high-value transactions. Third-party inspection services can verify that the goods being shipped actually exist, are of the correct quality, and are properly loaded. How to Achieve It: • Partner with internationally recognized inspection agencies like SGS, Bureau Veritas, or Intertek. • Include inspection clauses in your Letters of Credit or trade contracts. • Request photo and video documentation of the cargo, signed and timestamped by the inspector. 4. Implement Multi-Level Approval Systems Internal fraud can be just as damaging as external scams. Ensure that no single person can authorize major financial transactions or trade contracts without oversight. How to Achieve It: • Set up a maker-checker system where every transaction is reviewed and approved by more than one individual. • Use role-based access controls in your finance systems to separate duties. • Perform regular internal audits to catch inconsistencies and signs of tampering. 5. Stay Updated on Emerging Fraud Trend. Fraud tactics evolve rapidly. Stay informed about new schemes and methods by following industry news, joining trade associations, and attending finance webinars or workshops. How to Achieve It: • Subscribe to fraud alert newsletters from trade finance institutions and government agencies. • Share learnings within your team and update your fraud prevention policies accordingly. • Encourage your employees to report suspicious activity without fear of retaliation. Your global trade deals shouldn’t come with unnecessary risk. With the right fraud prevention strategies, you can operate with confidence, security, and peace of mind. Don’t wait until fraud strikes—protect your business today! Contact our team to explore how our trade finance solutions can help you safeguard your transactions and strengthen your global partnerships. Reach out now for a free consultation or subscribe to our newsletter for more actionable tips.