Understanding Trade Finance: Definition and Benefits

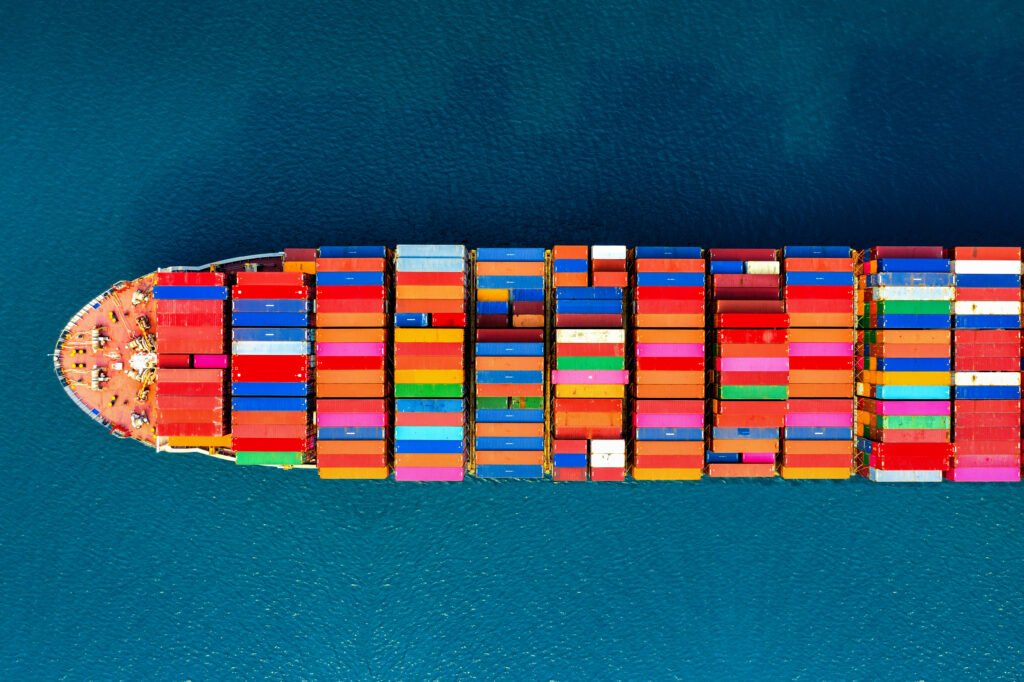

In the world of international trade, Letters of Credit (LCs) stand as one of the most reliable financial instruments for ensuring secure transactions between buyers and sellers. Whether you’re an importer or exporter, an LC can provide the financial assurance and risk mitigation needed to navigate the complexities of cross-border deals. In this blog, we’ll dive into the fundamentals of Letters of Credit, exploring how they work, their various types, and the crucial role they play in facilitating global trade.

By the end of this blog, you’ll have a solid grasp of what trade finance entails and how it can transform your business operations, giving you the tools to confidently engage in international trade while mitigating risks and optimizing cash flow.

Imagine you’re ready to expand your business into exciting new global markets, but you’re held back by concerns over payment risks, shipment delays, or even the possibility of fraud. These uncertainties can be daunting, making you hesitant to take that crucial leap. Trade finance steps in to provide the security and peace of mind you need, with solutions designed to safeguard both buyers and sellers. By using tools like Letters of Credit and bank guarantees, trade finance ensures that payments are made on time, goods are delivered as agreed, and both parties can engage in cross-border trade with confidence. With these protections in place, you can focus on growth and seize new opportunities without fear of financial setbacks.

As the International Trade Centre notes:

“Trade finance is the oil that keeps the wheels of international trade turning, offering critical support to businesses operating across borders.”

Keep reading to learn how trade finance can help your business navigate complex international markets, protect against risks, and improve cash flow, ultimately allowing you to focus on growth and expansion.

Use Letters of Credit (LCs): LCs are a trusted financial instrument that guarantees payment to the exporter once the terms of the contract are fulfilled, ensuring both parties can proceed with confidence. For importers, LCs provide assurance that they won’t need to release funds until goods are shipped and all conditions are met. This dual-layer protection makes LCs an essential tool in managing the complexities and risks of international transactions, creating smoother trade relations between buyers and sellers across borders.

Leverage Invoice Financing: Invoice financing allows businesses to access funds tied up in unpaid invoices by using them as collateral to secure immediate cash. This helps maintain liquidity, enabling you to continue operations and meet financial obligations without waiting for customers to pay. By using invoice financing, businesses can better manage cash flow and avoid disruptions caused by payment delays, leading to more predictable and stable financial operations.

Explore Export Credit Insurance: Export credit insurance shields your business from the risk of non-payment by international buyers, whether due to insolvency, political unrest, or other unexpected factors. This insurance not only safeguards your revenue but also provides the confidence to venture into new and potentially riskier markets without fearing significant financial loss. With export credit insurance in place, businesses can expand their global reach with the assurance that their receivables are protected, promoting more aggressive growth strategies.